September 2025

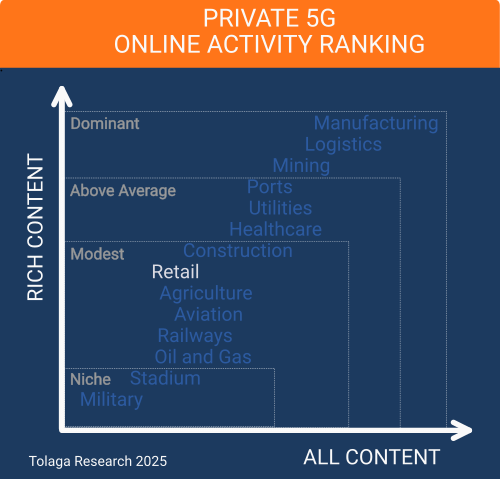

Retail is a modest industry vertical for Private 5G (P5G) market, with our online content survey ranking retail 8th out of the 14 industries researched.

Verizon, Ericsson, Nokia, and Cisco dominate the online narrative for P5G in retail, with solutions that enable advanced applications, such as cashierless checkout and AR/VR, aiming to improve operational efficiency while simplifying deployment and management.

Retailers face rising pressures from operational costs, supply chain disruptions, and digital competitors.

Hybrid network strategies are expected, with P5G complementing rather than replacing existing Wi-Fi.

P5G offers stronger security and more reliable performance, especially in high-density, business-critical environments.

Barriers remain, including high deployment costs, legacy system integration, and unclear ROI.

'Network-in-a-box' solutions show promise, but are still complex to implement.

Retailers must keep pace with digital technologies to remain competitive. For P5G, they require use-case-driven approaches, starting small and scaling up based on proven outcomes.

Brick-and-mortar retailers face mounting pressure as rising operational costs erode their profit margins, while e-commerce competitors reshape the market with greater convenience and lower prices. Retailers must also navigate ongoing supply chain disruptions, complex inventory management, and heightened consumer expectations for personalized service, fully stocked shelves, and immersive in-store experiences.

To remain competitive, retailers are pursuing digital transformation strategies that modernize their technology systems, optimize supply chains, and create immersive, customer-centric environments that blend the best of in-person and digital retail experiences. While most retailers currently rely on Wi-Fi for wireless connectivity, Private 5G (P5G) is gaining interest due to its superior security, scalability, and performance, particularly for advanced applications such as cashierless checkouts, shelf sensors, and supply chain visibility.

P5G is being piloted and deployed in retail to deliver ultra-secure, high-capacity, low-latency wireless connectivity that transforms store operations and enhances the customer experience. Major applications include real-time video surveillance and advanced security, mobile and cashierless point-of-sale systems, seamless digital payments, and robust inventory and asset tracking, all enabled by P5G's reliability and support for thousands of IoT devices. Interactive digital signage, AR/VR shopping experiences, location-based promotions, and omnichannel services enhance customer engagement, while robotic automation and smart energy management improve operational efficiency. These deployments often integrate with existing Wi-Fi and DAS infrastructure, and vendors now offer 'network-in-a-box' solutions touting rapid, secure connectivity in pop-up and temporary retail environments. However, while P5G provides clear benefits for security, scalability, and immersive retail, wider adoption is still limited by cost, complexity, and the need to demonstrate a strong return on investment compared to traditional Wi-Fi and public cellular networks.

Although retail has been slower to adopt P5G compared to other industries, such as manufacturing, a growing number of pilots and small-scale deployments highlight its transformative potential.

Online content published since 2022 that related to P5G for the retail industry was collected and filtered using proprietary web crawling, AI, and NLP tools, yielding a corpus of 152 relevant impressions (ALL CONTENT). Of this, 95 focused on company activity in the sector (RICH CONTENT), identifying 48 companies. Approximately 21.0% of the content in the corpus referenced multiple industry verticals in addition to retail, with an average of 2 to 3 other industries mentioned in this content.

The chart below compares the content corpus for P5G for the retail industry against other industry verticals to gauge relative market momentum. The analysis indicates that the retail sector is currently a modest vertical market segment for P5G.

Natural language processing (NLP) and AI tools were used to identify companies mentioned in the content corpus, measure their prevalence (BREADTH), and evaluate how frequently they appear alongside other companies (DEPTH). Of the 48 companies identified, the ranking of the top 10 is shown in the chart below.

Verizon provides P5G networks for retail that deliver secure, low-latency wireless connectivity to support real-time inventory tracking, cashierless checkout, and augmented reality applications. Their solution enables continuous store operations during disruptions by maintaining connectivity independently. Verizon offers an integrated service combining devices, software, and 5G connectivity for easier management and scalability across store sizes. This supports operational efficiency and customer experience improvements without major infrastructure changes.

Ericsson offers P5G solutions for retail that provide secure, reliable wireless connectivity to support in-store operations, warehouses, and temporary locations like pop-up stores. Their wireless WAN and 5G private networks eliminate dead zones and handover issues, aiming to enhance productivity and customer experience. Ericsson’s plug-and-play routers enable fast deployment with day-one connectivity and built-in security features, supporting digital signage, IoT devices, and seamless failover to maintain continuous operations. Centralized cloud management allows for simplified network control across multiple retail locations.

Nokia is advancing P5G for retail by partnering with companies like Andorix to deliver in-building 5G connectivity and neutral host networks across commercial and retail properties in North America. Their solution supports operational technology use cases such as energy management, building automation, and security, enabling applications like VR, indoor navigation, and IoT deployments. Nokia’s Digital Automation Cloud platform provides a scalable, secure private wireless network with edge computing, designed to enhance connectivity reliability and support digital transformation in retail environments.

Cisco offers P5G as a cloud-managed service that integrates with existing Cisco networks and security systems. It provides secure, high-performance connectivity with real-time device and policy management. The solution uses eSIM tech for remote device provisioning, supports scalable deployment, and enables use cases like autonomous retail and video surveillance. Cisco’s service reduces upfront costs and operational complexity for enterprises.

NLP and AI techniques were used to identify and classify keywords and phrases in the content corpus into 25 topics. Their frequency was measured (BREADTH) and their inter-relationships analyzed (DEPTH). The chart below shows the top 10 topics.

The most prominent topics in online content today are compute and communications, logistics 4.0, security, and artificial intelligence. Over time, we expect themes such as supply chain 4.0 and regulations and compliance to increase in prominence.

P5G is being piloted and deployed across diverse retail settings from flagship malls and mixed-use districts to citywide networks and pop-up stores, enabling secure, high-capacity connectivity for applications such as cashierless checkout, real-time inventory tracking, and immersive customer experiences. While vendors such as American Tower, JBG SMITH, HPE Aruba, Cisco, and Nokia are demonstrating their potential, widespread adoption remains limited by cost, integration challenges, and the strong incumbent role of WiFi.

Miracle Mile Shops is a 1.2-mile-long, enclosed retail and entertainment complex located inside Planet Hollywood Resort & Casino on the Las Vegas Strip. In December 2023, American Tower, in collaboration with technology partners, deployed a standalone private 5G network at Miracle Mile Shops, integrating it with the property’s existing Distributed Antenna System (DAS) to deliver enhanced security, real-time video surveillance, digital signage, secure point-of-sale systems, and robotic automation—all enabled by ultra-low latency and high-capacity connectivity. This converged infrastructure supports advanced edge cloud applications, energy optimization, and immersive experiences for tenants and visitors, while serving as a scalable pilot for future smart venue deployments.

JBG SMITH, a real estate investment trust (REIT), deployed a P5G network at its National Landing development in partnership with Federated Wireless in September 2022. Leveraging CBRS shared spectrum, the network delivers ultra-reliable, high-speed, and secure wireless connectivity that surpasses the capabilities of traditional Wi-Fi and public cellular. It supports a broad range of applications for residents, retailers, and entertainment venues, including real-time inventory tracking, seamless digital payments, interactive AR/VR shopping experiences, and IoT-enabled smart shelving. With the capacity to support thousands of simultaneous device connections and integrated edge computing, the network also powers mobile point-of-sale systems, cashierless checkout, location-based promotions, advanced video surveillance, and secure on-site data processing.

Las Vegas has launched an extensive municipal P5G network in the United States, led by NTT Ltd. and built on CBRS shared spectrum. This open, citywide network delivers a broad range of smart city applications, including public safety, traffic management, digital education, healthcare, and IoT-enabled services. For the retail sector, the network offers a secure and scalable platform for advanced capabilities, including real-time inventory tracking, mobile point-of-sale systems, interactive AR/VR shopping experiences, location-based promotions, and IoT-driven store analytics. By enabling seamless digital services and secure on-site data processing, the P5G infrastructure empowers local retailers to enhance operational efficiency, improve customer engagement, and compete more effectively in a connected urban environment.

The Exchange District in Mississauga, Canada, is a large, master-planned, mixed-use urban hub featuring four prominent towers that offer retail, office, residential, hotel, and entertainment spaces. As part of its vision to be a next-generation urban destination, the development has integrated both private and neutral-host 5G networks into its digital infrastructure, a strategy aimed at delivering high-capacity, low-latency wireless connectivity across the entire district. For retail, this advanced wireless ecosystem is designed to enable enhanced digital experiences, such as interactive wayfinding, augmented reality in stores, real-time inventory management, and seamless customer engagement, supporting a vibrant, tech-forward shopping environment.

A range of vendors, including Ericsson-Cradlepoint, Firecell, G-REIGNS, and Pente Networks, offer “network-in-a-box” solutions that enable retailers to quickly deploy secure, high-performance private or cellular LTE/5G networks in pop-up and temporary retail environments, bypassing the need for fixed infrastructure. These portable systems provide out-of-the-box connectivity, built-in enterprise-grade security, and centralized management, making them ideal for seasonal, event-based, or mobile stores where rapid setup, reliability, and data protection are critical. The technology aligns with the needs of temporary retail, offering plug-and-play operation, support for POS and digital engagement systems, and the flexibility to scale or relocate as required. However, 'network-in-a-box' solutions still exhibit implementation complexities that hinder widespread adoption. These complexities include customization requirements for specific operational needs, integration with existing IT systems, obtaining necessary spectrum licenses, and addressing security and regulatory requirements.

In January 2025, HPE Aruba introduced a 'Retail-Ready Networking Portfolio' combining secure P5G, Wi-Fi 7, and edge computing. Home Depot has adopted the solution to support wireless POS systems, inventory tracking, kiosks, curbside pickup, and outdoor warehouse coverage. Ross Stores is also leveraging the portfolio to enable IoT applications, secure transactions, and real-time inventory management.

Cisco's Meraki platform is widely used in retail for smart cameras, sensors, remote IT management, asset tracking, and personalized customer engagement. While retail-specific P5G announcements are pending, Meraki can be readily integrated with Cisco Private 5G to extend these capabilities in a P5G environment.

P5G vendors, including Celona, Ericsson, and Nokia, are collaborating with real estate operators to embed neutral host networks into commercial properties. For instance, in June 2025, Nokia announced a partnership with Andorix to accelerate P5G and edge computing solutions across the North American real estate sector, offering retailers pre-integrated access to next-generation connectivity.

Key technologies, such as artificial intelligence (AI), augmented and virtual reality (AR/VR), and edge computing, are seeing increased adoption among retailers, and in many cases, benefit from P5G’s capabilities. However, wider adoption is still limited by concerns over return on investment (ROI), deployment complexity, legacy system integration, and the need for clear advantages over lower-cost alternatives, such as Wi-Fi.

For retailers, the strategic positioning and trade-offs of private 5G (P5G) remain fluid, shaped by the evolving maturity of digital transformation strategies, advancements in both P5G and Wi-Fi technologies, shifting consumer expectations, and the capabilities of their technology partners. Given that most retailers have already made significant investments in Wi-Fi to support existing digital services, wholesale replacement with P5G is unlikely. Instead, P5G deployments are expected to focus on new services that Wi-Fi cannot support, or existing applications where Wi-Fi no longer delivers adequate reliability, performance, or security. In all cases, adoption will hinge on a clear and demonstrable return on investment.

Security is often highlighted as a key differentiator when comparing Wi-Fi and P5G. Over the past decade, numerous high-profile security breaches linked to Wi-Fi networks have damaged the reputations of affected retailers. While P5G does offer a more robust security architecture and a smaller potential attack surface than Wi-Fi, most past breaches have been the result of misconfigured or poorly managed Wi-Fi systems rather than flaws in the underlying Wi-Fi security standards. P5G mitigates many of these risks by design, though this comes with increased system complexity and higher implementation costs.

The reliability and capacity of both Wi-Fi and P5G continue to advance, with innovations, such as massive MIMO for improved radio performance, often developed for one technology and later adopted by the other. However, a fundamental difference between Wi-Fi and P5G lies in how the radio spectrum is managed.

P5G typically operates in either shared and carefully coordinated spectrum (such as Citizens Broadband Radio Service, or CBRS) or in privately licensed spectrum allocated exclusively for enterprise use, including retail operations. In contrast, Wi-Fi operates in unlicensed spectrum, which is freely accessible and shared among many devices, often with minimal regulatory constraints.

Because P5G spectrum is more tightly controlled, either through coordinated sharing mechanisms or dedicated licensing, it offers greater potential for reliable capacity and performance than Wi-Fi, especially in high-density or interference-prone environments. This advantage becomes critical in retail settings, where the proliferation of IoT devices, adoption of advanced services such as computer vision for security and AR/VR for customer engagement, and reliance on ultra-reliable connectivity for applications like cashierless checkouts all demand a more robust and secure wireless infrastructure.

P5G is emerging as a promising enabler for digital transformation in brick-and-mortar retail, offering superior security, reliability, and performance compared to traditional Wi-Fi, especially for mission-critical and advanced applications such as cashierless checkout, real-time inventory tracking, and immersive in-store experiences. Early deployments and pilots at flagship locations, as well as through “network-in-a-box” solutions, demonstrate P5G’s potential to support seamless connectivity, automation, and customer engagement. However, widespread adoption remains in its early stages, constrained by concerns over ROI, integration complexity, and the entrenched presence of Wi-Fi. Retailers are likely to adopt a hybrid approach, leveraging P5G for new, high-value use cases while maintaining Wi-Fi for established applications. Ultimately, the strategic value of P5G in retail will depend on its ability to deliver tangible business outcomes, such as improved operational efficiency, enhanced security, and differentiated customer experiences, at a justifiable cost.

Retailers exploring P5G should adopt a phased approach, focusing on specific use cases and scenarios. Start by launching pilot projects that target applications where private 5G offers clear advantages over Wi-Fi, such as ultra-reliable connectivity, low latency, or enhanced security. Rather than replacing existing Wi-Fi infrastructure, retailers should pursue network architectures that combine both technologies, leveraging their complementary strengths and preserving the value of previous investments.

Security and compliance should be a central focus, leveraging the built-in protections of P5G while ensuring proper network configuration, management practices, and employee training to reduce risks and meet regulatory standards. Forming partnerships with technology providers, property managers, and industry associations can help retailers access integrated solutions, share best practices, and accelerate deployment.

Each application should be assessed for its business value and ability to scale, with results carefully documented to support a broader rollout strategy. Retailers should also invest in skills development and remain proactive in identifying how P5G can support future innovation, including augmented and virtual reality, artificial intelligence, and robotics, to stay competitive in an increasingly digital marketplace.