September 2025

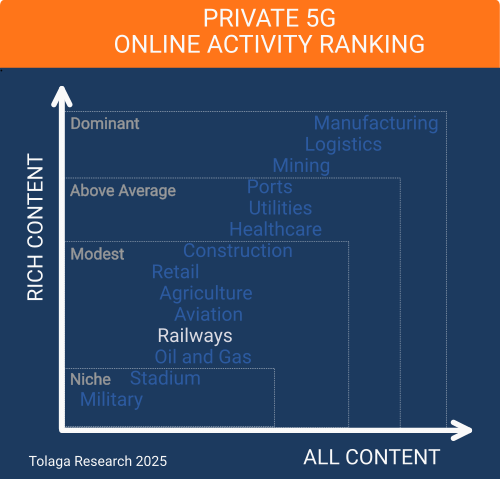

The railway industry has had a modest impact on the private 5G (P5G) market: Our online content survey ranks railways as 11th out of the 14 industries researched.

Nokia leads the online narrative in railway P5G: It has early FRMCS-aligned deployments that enhance resilience and low-latency connectivity, although the full rollout is still in progress.

P5G is a game-changer for rail, enabling fast, secure, and low-latency connectivity for automation, safety, and data-driven operations.

Adoption is accelerating globally, led by Europe and Asia, though most deployments are still in trial or early rollout phases.

FRMCS is the long-term goal, with P5G playing a key role, though migration will be gradual and complex, extending into the 2030s.

Hybrid networks are emerging, blending public and P5G to meet rail-specific performance and coverage needs.

Advanced use cases are emerging, from AR/VR for maintenance and real-time video to autonomous and communication-based train control trials.

The ecosystem is expanding, with technology vendors, integrators, rail operators, and governments backing trials and early deployments.

Challenges persist, including high cost, legacy integration, and the slow finalization of FRMCS standards.

The railway industry is undergoing a steady digital transformation, adopting technologies such as AI, IoT, data analytics, cloud computing, and digital twins to improve efficiency, safety, and passenger experience. Progress varies across operators due to legacy system constraints, integration challenges, and regulatory requirements; however, these tools are enabling real-time monitoring, predictive maintenance, traffic optimization, and data-informed decision-making. AI-powered systems enhance passenger information and capacity management, while cloud-based analytics and digital twins support more proactive asset planning.

Private 5G (P5G) networks are playing an increasingly important role by providing high-speed, low-latency, and secure wireless connectivity for critical functions such as autonomous control, emergency communications, and augmented reality (AR) based maintenance. Operators in several countries are piloting 5G-enabled applications, and many, particularly in the European Union, are preparing for the Future Railway Mobile Communication System (FRMCS), a 5G-based standard set to replace GSM-R by 2035. As these technologies mature, rail networks are gradually becoming more data-driven, resilient, and customer-focused.

Online content published since 2022 that related to P5G for the railway industry was collected and filtered using proprietary web crawling, AI, and NLP tools, yielding a corpus of 128 relevant impressions (ALL CONTENT). Of this, 101 focused on company activity in the sector (RICH CONTENT), identifying 73 companies. Approximately 22.0% of the content in the corpus referenced multiple industry verticals in addition to oil and gas, with an average of between 2 and 3 other industries mentioned in this content.

The chart below compares the content corpus for P5G for the railway industry against other industry verticals to gauge relative market momentum. The analysis indicates that the railway industry is currently a modest vertical market segment for P5G.

Natural language processing (NLP) and AI tools were used to identify companies mentioned in the content corpus, measure their prevalence (BREADTH), and evaluate how frequently they appear alongside other companies (DEPTH). Of the 73 companies identified, the ranking of the top 10 is shown in the chart below.

Nokia has taken the lead in the online narrative for P5G in railways. For example, it has deployed what it describes as the world’s first commercial 5G standalone (SA) radio network in the 1900 MHz (n101) band for railway use, with Deutsche Bahn in Germany. The deployment is at DB’s test track, is aligned with FRMCS requirements, and includes fail-over, self-healing, real-time monitoring, and low-latency capabilities. It is part of broader European efforts for FRMCS rollout, though full operational deployment (especially cross-border, automated train operations, etc.) remains in progress.

NLP and AI techniques were used to identify and classify keywords and phrases in the content corpus into 23 topics. Their frequency was measured (BREADTH) and their inter-relationships analyzed (DEPTH). The chart below shows the top 10 topics.

The most prominent topics in online content today are compute and communications, security, and passenger rail. Over time, we expect themes such as artificial intelligence, intralogistics and interlogistics, and regulations and compliance to increase in prominence.

FRMCS is a European-led standard developed under the auspices of UIC (International Union of Railways) and ETSI. It supersedes GSM-R and utilizes 5G technology to support mission-critical applications, including real-time train control, automation, video surveillance, and predictive maintenance. Its rollout is a significant enabler of rail transport digitalization, enabling improved safety, operational efficiency, and innovative passenger services. European and international projects, including 5GRAIL, have been validating FRMCS specifications through large-scale field trials. The transition is designed to be gradual, allowing GSM-R and FRMCS to coexist during the initial phases.

While FRMCS is predominantly a European standard, it is being trialed with plans for future deployment outside the EU in countries such as Australia, China, India, and South Korea. In addition to supporting the FRMCS initiative, China is pursuing its variant technology standard, namely 5G-R. While FRMCS efforts tend to incorporate P5G, FRMCS is technology agnostic. Furthermore, in many cases, FRMCS might operate over public 5G networks, as demonstrated by Finland’s Digirail project and Ericsson’s trial network with PKP (Polish State Railways) in Poland.

FRMCS is progressing on an extended development timeline due to a combination of technical, operational, and regulatory challenges. The complete system specifications (FRMCS V1) are still being finalized, with a complete baseline expected around 2026 or 2027. Many existing rail systems, particularly those upgraded with ETCS Baseline 3 onboard units (approximately 30% of European rolling stock), are compatible with GSM-R but not yet compatible with FRMCS. This will require extensive and costly retrofitting, including testing, reauthorization, and certification. Equipment suppliers such as Alstom, Kontron, Ericsson, Frequentis, Huawei, and Nokia cannot begin large-scale production of FRMCS-compliant products until the specifications are fully stabilized, which is likely to delay broad deployment into the 2030s. The rail sector’s inherently long lead times for integrating and certifying new systems across varied rolling stock further contribute to delays. Compounding the challenge, GSM-R cannot be decommissioned until FRMCS is fully operational, and regulations require a five-year advance notice before its shutdown. These factors make the FRMCS migration both gradual and capital-intensive, with rollout expected to continue throughout the 2030s in alignment with the planned GSM-R phase-out around 2035.

Despite the extended timeline for formal standards like FRMCS, some railway operators are moving forward with P5G initiatives. These efforts are relatively modest and aim to leverage the current capabilities of P5G through solutions that integrate with existing legacy systems while remaining adaptable to future standards as they emerge. Several notable examples are explored below.

Launched in September 2020, the 5GMED project aimed to design and implement a cross-border 5G architecture for road and rail transport between Spain and France. Backed by substantial European Commission funding, the project brought together a consortium of 21 partners from seven countries to test advanced 5G features, including network slicing, to support a range of railway data flows with distinct quality-of-service requirements, from safety-critical operations to commercial services. It also evaluated the compatibility of complementary technologies such as satellite communications, Train Access Networks, and sidelink communications in varied environments, including tunnels, open terrain, and high-speed conditions up to 300 km/h. A central objective was to explore the gradual migration of certain railway communication services from dedicated private networks to public 4G/5G or satellite infrastructure, offering greater flexibility and potential cost savings. Cross-border interoperability was a major focus, ensuring seamless communication across national systems. SNCF (French National Railways) played a key role, contributing operational expertise and deploying a commercial TGV train to validate FRMCS-aligned applications. The project concluded in mid-2024, following successful demonstrations in October 2023 that showcased cross-border 5G connectivity, remote driving, network slicing, and enhanced railway communications. A final public event in June 2024 highlighted the project's results and live demonstrations, affirming 5GMED’s role as a successful proof of concept that advances the path toward future 5G-based railway systems such as FRMCS.

In March 2025, it was announced that Airspan Networks and Druid Software had jointly deployed a P5G network for a major European railway operator, with Boldyn Networks leading the project. The network spans maintenance and operational sites, delivering secure, high-performance connectivity tailored to critical railway functions. According to the announcement, it will support advanced use cases such as augmented reality (AR)-enabled maintenance using tools like HoloLens, low-latency operational technology (OT) integration for monitoring and controlling key systems, and real-time, high-capacity communication with trains, whether stationary or in motion.

ÖBB, Austria’s national railway company, is advancing the use of P5G networks as part of its broader digital transformation strategy to enhance communication, safety, and operational efficiency. In July 2020, ÖBB, in collaboration with A1 Austria and Nokia, launched a pilot project to test network slicing using A1's existing 4G/LTE and 5G infrastructure. This initiative marked a significant step toward deploying secure, dedicated 5G connectivity tailored to railway-specific applications such as real-time monitoring and communications-based train control. These P5G networks are designed to replace legacy systems, support automation, and improve network reliability, aligning with wider European and global efforts to modernize rail transport. Building on the initial pilot, the partnership expanded in early 2024 into live network slicing trials, providing operational-grade precision and reliability to support ÖBB’s evolving requirements.

SNCF is actively advancing P5G as part of its broader digital transformation and modernization strategy for the railway. Beginning in mid‑2021, in partnership with Orange and Nokia, SNCF expanded a government‑supported industrial 5G Living Lab, initially launched at Rennes station, to include two major maintenance sites. This enabled ultra-fast wireless connectivity to support industrial applications, such as remote process control, maintenance data transfer, mobile camera systems, and real-time video analysis, aimed at enhancing operational efficiency and safety. In parallel, SNCF has collaborated with Nokia to establish a dedicated 5G laboratory for preparing the transition to FRMCS, with a focus on railway-specific applications such as signalling, automation, and remote maintenance.

Deutsche Bahn has been actively trialing and deploying both private and public 5G technologies as part of its broader network modernization efforts. In December 2019, it awarded Nokia a contract to develop and test the world’s first standalone P5G network for automated rail operations in Hamburg. As part of this project, four trains on a 23-kilometre section of the S-Bahn Hamburg network were equipped with advanced digital systems, and the corresponding track infrastructure was upgraded. At the ITS World Congress in October 2021, these trains demonstrated highly automated operation using Automatic Train Operation (ATO) and ETCS, including a fully automated, staff-free shunting process at Bergedorf station powered by the standalone P5G network. In October 2024, Deutsche Bahn, the German government, and four major mobile operators announced plans to upgrade the Berlin–Hamburg rail corridor between August 2025 and April 2026 by installing new public 5G infrastructure alongside planned track renovations. This initiative aims to deliver seamless 5G coverage and support the phased rollout of FRMCS. In parallel, Deutsche Bahn is operating an extensive FRMCS and 5G test environment in the Ore Mountains in collaboration with Nokia and Kontron. Following an initial evaluation in mid-2023, the testbed will remain active through 2026, serving as a proving ground for next-generation digital railway applications.

Other European rail operators are actively exploring the future role of both public and P5G in their operations. For instance, Swiss Federal Railways (SBB) began FRMCS-related studies and technical evaluations in 2023, focusing on radio planning, tendering, and deployment scenarios. These include both a private standalone FRMCS network and hybrid models that incorporate national public mobile providers. SBB currently operates GSM-R with full coverage on main lines, supplemented by public mobile networks to extend coverage in rural areas.

In Spain’s Basque region, the MoySEST project was launched around 2022–2023 as a 36-month experimental development initiative aimed at advancing critical broadband communication systems for rail transport using optimized 5G technology. The project includes testing, piloting, and validation phases, and is led by Teltronic in collaboration with partners Kenmei, Nemergent, and S2 Grupo, with support from rail operators ETS (Euskal Trenbide Sarea) and Euskotren. In July 2025, a successful trial was conducted on Euskotren’s Line 1, demonstrating reliable train-to-ground communications.

In the United Kingdom (UK), the East West Rail project, announced in February, is deploying a P5G network along the section between Bicester and Bletchley. This initiative, part of the new rail line, involves technology partners such as AWTG (system integrator), Airspan (radio equipment supplier), and Icomera (rail connectivity specialist). The network aims to deliver seamless, high-speed internet access for passengers and enhanced operational efficiency for train operators. Additionally, it will extend P5G coverage to local businesses along the rail corridor. In addition, the UK rail industry and key players, such as Network Rail and Systra UK, are actively developing strategies for the UK’s GSM-R upgrades to FRMCS, as well as strategies for public and private 5G adoption.

China is actively advancing P5G networks, which are explicitly designed for railways, under the national initiative known as 5G-R (5G Railway). This program aims to build a dedicated, large-scale P5G communication system to support railway production, operations, and the delivery of intelligent services. Similar to Europe's FRMCS, 5G-R is intended to replace the legacy GSM-R system, enabling smart railway management, automation, and autonomous operations. In 2023, spectrum in the 2.1 GHz band was approved for pilot testing and was subsequently cleared for continued use in early 2025. Ongoing development focuses on advanced capabilities such as network slicing and mission-critical performance, ensuring reliable connectivity for high-speed trains and during peak congestion, while supporting the broader vision of intelligent rail infrastructure.

In parallel with these national efforts, several Chinese cities have begun deploying P5G networks for metro systems. In Wuhan, the metro system deployed P5G in 2023 to support advanced applications, including automated train control, emergency video intercom, and operational services, which improve system responsiveness and service reliability. In Shanghai, which already benefits from robust public 5G coverage, a trial deployment of a dedicated P5G “shadow network” for metro operations was launched in April 2025. This private network operates in parallel with the public infrastructure, enabling real-time diagnostics, AI-powered predictive maintenance, and behind-the-scenes automation for smart metro operations.

Hong Kong International Airport integrated P5G into its Automatic People Mover (APM) rail system around 2022 as part of its broader enterprise P5G rollout. The solution, delivered by Hitachi Rail and integrated with the Thales communications-based train control (CBTC) system used on the APM, enhanced train-to-ground communications, improved reliability, and reduced operational costs compared to traditional radio systems.

Japan began deploying P5G networks for railways, referred to as “Local 5G”, in December 2021, with demonstration projects aimed at enhancing safety and operations through the use of AI and high-resolution video transmission. These networks have been implemented at major stations, including Jiyugaoka, Kikuna, Myorenji, and Yokohama, on the Tokyu Toyoko and Yokohama Minatomirai Lines, as well as along sections of the Hanshin Main Line operated by Hanshin Electric Railway. Since August 2024, Tokyo Metro has been conducting trials on the Marunouchi Line to evaluate the use of Local 5G in supporting a communications-based train control (CBTC) system. These trials focus on assessing radio wave propagation, reliable train-to-trackside communication, and the transmission of control and sensor data in both underground and above-ground environments.

Several railway operators in South Korea have begun deploying P5G networks to support advanced rail operations. In mid-2024, the Korea Railroad Research Institute (KRRI) announced plans to install a P5G network on a 600-meter test track at its Osong test center, operating in the 4.7 GHz band. The network enables high-bandwidth data transmission, including 5G video calls on high-speed trains, as well as support trials for autonomous train control, cloud-based analytics, and emergency response systems. In July 2025, Airport Railroad (AREX) announced the rollout of a commercial P5G network to replace its existing LTE-R system, in collaboration with LG U+. Earlier that year, Korea Railroad Corporation (Korail) launched P5G trials at several Seoul stations and signed a memorandum of understanding with LG Electronics to implement a customized P5G network at a station in Seoul. Beyond public rail, POSCO, South Korea’s major steel producer, revealed in 2023 that it was using P5G to automate train operations within its industrial rail network.

P5G networks are becoming an essential component in the digital transformation of some railway companies. Offering high-speed, low-latency, and secure wireless connectivity, these networks enable advanced applications such as autonomous train trials, real-time video monitoring, predictive maintenance, and augmented reality for maintenance and operations. Active deployments and pilots span Europe’s FRMCS trials in countries such as Austria, Germany, and France, as well as Asia’s rail-specific 5G initiatives in China, South Korea, and Japan. Additionally, early-stage private LTE infrastructure is being developed in North America, including freight yard applications in the United States. While the complete transition to FRMCS and standardized 5G-based rail communications will extend into the 2030s, current projects demonstrate the growing utility of private wireless for modern railways.

These developments reflect a broader shift in the role of telecom and technology providers in the railway ecosystem, where industry partnerships, testbeds, and commercial rollouts are converging to create interoperable, resilient digital infrastructure. As P5G becomes increasingly integrated with legacy and public systems, rail operators are better positioned to automate operations, enable cross-border communication, and make more data-driven decisions, paving the way for smarter, safer, and more sustainable rail transport worldwide.