September 2025

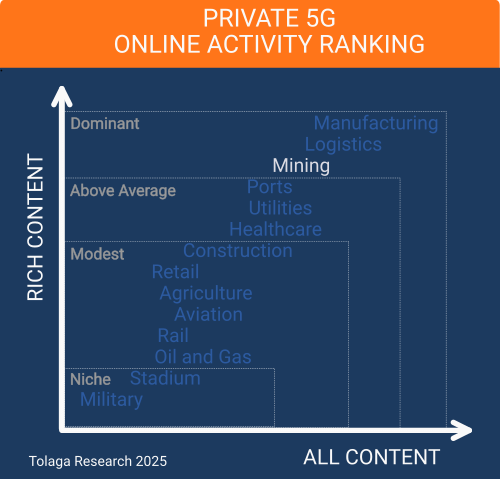

Mining is an important sector for private 5G (P5G), with our online content survey ranking mining 3rd out of the 14 industries researched.

Ericsson and Nokia lead the online narrative for P5G deployments in mining, enabling automation, remote operations, and advanced analytics, boosting safety, productivity, and efficiency.

Demanding Environments: Mining requires resilient, real-time connectivity across remote, hazardous, and dynamic sites.

Innovation Legacy: The industry has a strong track record in adopting advanced technologies, now extending to P5G.

Critical Enabler: P5G supports high-performance use cases, including autonomous haulage, remote drilling, and connected worker safety.

Technology Integration: P5G complements existing systems such as Wi-Fi, LoRaWAN, and TETRA by delivering superior performance for mission-critical tasks.

Adoption Barriers: Key challenges include the complexity of underground RF, legacy integration, spectrum licensing, cybersecurity, and skills gaps.

Global Momentum: Successful pilots and regulatory support are driving modest adoption across major mining regions.

Path Forward: A phased rollout, strong partnerships, workforce upskilling, and advanced technologies are crucial for scaling P5G in the mining industry.

Mining companies operate in unique and often extreme conditions, shaped by harsh, remote, and variable environments. Operations typically span vast, rugged terrains and rely on heavy, specialized machinery capable of withstanding dust, vibration, humidity, and temperature fluctuations. Mines function continuously, involving complex, multi-step workflows, such as drilling, blasting, hauling, and processing, across spatially distributed sites. Safety remains a core concern due to risks such as ground instability, exposure to hazardous materials, and interactions with heavy equipment. These conditions also pose logistical challenges, including workforce mobility, power supply, and environmental impact, all of which require precise coordination, real-time monitoring, and resilient communication systems to ensure safety, efficiency, and compliance.

The mining industry has a long-standing reputation for technological innovation, particularly in enhancing operational efficiency, workforce safety, and environmental sustainability. It pioneered autonomous haul truck prototypes in the 1990s and was an early adopter of private cellular networks in the early 2000s using 2G and 3G technologies. More recently, mining companies have embraced private 4G/LTE and Private 5G (P5G) networks to enable smart mining technologies that leverage autonomous vehicles, IoT sensors and actuators, big data analytics, and artificial intelligence.

These smart mining solutions enable real-time automation and control, predictive maintenance, optimized operations, and environmental monitoring. Autonomous trucks, drilling rigs, and excavators can now be remotely operated with ultra-low latency via P5G and industrial wireless networks, reducing the need for on-site personnel and improving safety in hazardous areas. Precision navigation and situational awareness are achieved through GPS, IoT sensors, and real-time video, enabling autonomous or semi-autonomous operation with minimal human intervention.

Worker safety is further enhanced by wearable devices and connected sensors that enable real-time health and location tracking, providing instant alerts and supporting rapid emergency response. Additionally, digital twins and real-time analytics allow operators to simulate, visualize, and optimize operations from centralized control centers, facilitating predictive maintenance, remote management, and efficient resource utilization. Real-time data collection on emissions, energy use, and environmental conditions also supports sustainable operations, helping to meet regulatory requirements. This enables modern mining operations to be not only more productive and safer but also more adaptive and environmentally responsible.

Wireless communications are vital for mines and are typically supported by a complex network of technologies, including Wi-Fi, 5G, Low Power Wireless Access (LPWA) technologies such as LoRaWAN, and TETRA trunk radio communications.

TETRA (Terrestrial Trunked Radio) is a digital mobile radio standard widely deployed for mission-critical communications. In the mining sector, TETRA is especially valued for supporting emergency response, worker safety, and efficient coordination between teams and equipment. Its robust coverage and interoperability make it a preferred choice for connecting personnel and enabling real-time operational management.

Low-Power Wide-Area (LPWA) technologies, such as LoRaWAN, are primarily used in mining for real-time monitoring and asset tracking across large, remote, or underground sites. These networks enable battery-powered sensors to transmit data over long distances with minimal energy consumption, supporting applications such as environmental monitoring (air quality, gas levels, temperature), equipment health tracking, and worker safety systems.

Wi-Fi is used in mining operations, primarily for non-critical applications such as communications in surface facilities, workshops, and administrative buildings, as well as basic connectivity in some underground areas. It supports functions such as personnel tracking, voice communications, and limited data transmission, where coverage is feasible. However, due to limitations in range, reliability, and latency, especially in harsh, expansive, or underground environments, Wi-Fi is increasingly being supplemented or replaced by more robust technologies, such as Private LTE and P5G. P5G supports critical applications that require high bandwidth, low latency, and high reliability, such as autonomous haulage, remote-controlled drilling, real-time equipment and environmental monitoring, high-definition video surveillance, and connected worker safety systems.

Adopting private 5G in mining presents several formidable challenges. Underground environments are especially complex, where signal attenuation through dense rock and constantly shifting tunnel geometries makes consistent coverage difficult. These conditions demand advanced RF planning and resilient network architectures. Integrating private 5G with legacy equipment is another critical hurdle, as much of the existing machinery was not initially designed for connectivity or automation. This often requires customized interfaces, retrofitting, and software adaptation.

Regulatory compliance adds further complexity, as mining companies must navigate varying licensing regimes, safety certifications, and spectrum allocation processes across different jurisdictions. Cybersecurity risks must also be addressed, particularly as connectivity increases the attack surface in remote and industrial environments. In addition, mining operators face a pronounced skills gap in 5G technologies and must manage the total cost of ownership, which includes not only the initial deployment but also ongoing maintenance, workforce training, and future upgrades. Realizing the full benefits of P5G in mining requires careful planning, strong ecosystem partnerships, and significant investment.

However, several key initiatives are actively helping to lower the barriers to adoption. Regulatory support has improved, with many governments in major mining regions allocating dedicated spectrum for industrial use, streamlining licensing and deployment processes. Collaborative frameworks are also emerging, involving mining companies, technology vendors, academic institutions, and research organizations to address integration challenges, develop workforce capabilities, and tailor technologies to mining-specific requirements.

One notable example is the 5G Kankberg project in Sweden, where Boliden, Telia, and Ericsson collaborated under Telia’s 5G partner program and the EU-backed Sustainable Intelligent Mining Systems (SIMS) initiative. This effort produced the world’s first underground 5G network, designed to enable automation, enhance safety, and support sustainable mining practices. Similar partnerships are now being replicated across other mining regions worldwide.

Digital transformation programs are becoming core to mining strategies, with many operators pursuing pilot projects and phased rollouts. These enable gradual integration with legacy systems and provide the opportunity to validate use cases in real-world conditions before scaling up. Technological advances—such as edge computing, AI-based network optimization, and explosion-proof equipment—are also making private 5G deployments more robust and suited to harsh mining conditions. Finally, close partnerships with leading technology providers are accelerating adoption by delivering proven solutions, implementation support, and access to industry best practices focused on operational efficiency, worker safety, and environmental sustainability.

Online content published since 2022 that related to P5G in mining was collected and filtered using proprietary web crawling, AI, and NLP tools, yielding a corpus of 261 relevant impressions (ALL CONTENT). Of this, 218 focused on company activity in the sector (RICH CONTENT), identifying 134 companies. Approximately 22.0 % of the content in the corpus referenced multiple industry verticals in addition to mining, with an average of 2 to 3 other industries mentioned in this content.

The chart compares the content corpus for P5G in mining against other industry verticals to gauge relative market momentum. The analysis indicates that mining is currently a dominant vertical market segment for P5G.

Natural language processing (NLP) and AI tools were used to identify companies mentioned in the content corpus, measure their prevalence (BREADTH), and evaluate how frequently they appear alongside other companies (DEPTH). For the 134 companies identified, the ranking of the top 10 is shown in the chart below.

Ericsson is deploying P5G in mining to replace Wi-Fi with high-capacity networks that support remote operations, automation, and advanced video and data analytics. These networks provide wide-area connectivity for autonomous fleets and teleremote machinery, improving productivity, safety, and uptime in both surface and underground mines. Ericsson’s solution is globally scalable, paving the way for further digital transformation with AI, AR/VR, and automation technologies.

Nokia is rolling out P5G in mining for high-capacity wireless connectivity for open-pit and underground operations. Its networks support remote-control drilling, autonomous hauling, drone-based monitoring, and advanced analytics, enhancing safety, efficiency, and productivity. Nokia emphasizes low latency, wide coverage, and mission-critical communications to accelerate digital transformation across the mining sector.

NLP and AI techniques were used to identify and classify keywords and phrases in the content corpus into 24 topics. Their frequency was measured (BREADTH) and their inter-relationships analyzed (DEPTH). The chart below shows the top 10 topics.

The most prominent topics in online content today are compute and communications, smart mining, and remote operations. Over time, we expect use-case-driven themes, such as augmented and virtual reality and mine asset management, to gain prominence as digital solutions continue to mature.

Although the mining industry was an early adopter of Private 4G-LTE and P5G, overall adoption has been slow and uneven across the sector. Deployments span key mining regions, including North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Leading Australian miners such as Newmont and Fortescue Metals Group (FMG) are leveraging P5G to drive automation, enhance safety, and boost operational efficiency.

Newmont has deployed P5G at its Cadia, Boddington, and Tanami mines using Ericsson technology. These networks support tele-remote bulldozing, autonomous operations, and underground connectivity trials. Newmont’s tele-remote system enables centralized control of up to 12 dozers across 8 square miles from a single P5G site, achieving uplink speeds of 175 Mbps. The company’s autonomous fleet includes drill rigs, graders, and haul trucks operating above and below ground. In partnership with Ericsson and Telstra Purple, Newmont launched underground P5G trials in February 2023, testing automation, real-time data, video transmission, and connected worker solutions. Following positive results reported in August 2024, Newmont plans to expand its P5G footprint.

FMG initially contracted Aqura Technologies in October 2020 to deploy a private 4G-LTE network at its Iron Bridge magnetite project. Since then, it has trialled and extended P5G deployments across multiple sites. These efforts support fleet automation, logistics, and safety improvements, delivering a 23% increase in haulage efficiency, a 17% reduction in fuel consumption, and a 34% improvement in maintenance scheduling.

Other miners, such as South32, are also exploring transitions from 4G-LTE to P5G to enhance digital operations.

Newmont plans to expand P5G to its North American sites following its success in Australia. In Canada, several deployments are already active. Kirkland Lake Gold began deploying a P5G network in January 2022, supported by Rogers, across its 80-square-kilometer operations in Ontario. NORCAT announced Canada’s first underground P5G deployment in October 2022, utilizing Ericsson technology, with a full rollout announced in June 2025. In 2023, De Beers deployed a Nokia-powered P5G network at the Gahcho Kué mine in Canada’s Northern Territories. In September 2024, MacLean Engineering partnered with Bell to roll out a 4G-LTE/P5G network at its Sudbury facility, supporting automation, remote operations, and real-time equipment monitoring.

In 2024, Ericsson deployed P5G at three copper mines in Mexico, supporting operations up to 0.6 miles deep. Earlier, in September 2021, AngloGold Ashanti partnered with Nokia to conduct Latin America's first underground standalone P5G trial at its Jericó site in Colombia. The trial showcased the feasibility of using 5G for mission-critical communications, remote teleoperation, and drone inspections in demanding underground environments, highlighting opportunities to enhance safety, automation, and productivity.

P5G networks are being actively deployed for mining operations in Europe, with notable projects in Finland and Spain. In Finland, Agnico Eagle’s Kittilä gold mine operates one of the first underground P5G networks, which was deployed in 2022 by Nokia. This network supports autonomous machinery, enhancing safety and reliability both above and below ground. In early 2025, Vodafone and Geoalcali began rolling out a private 5G network at the Muga mine in northern Spain to enable real-time data access, remote equipment control, and advanced digitalization, including video surveillance and digital twins, as well as access control, Wi-Fi connectivity, and active drone monitoring for enhanced safety and operational efficiency.

In January 2025, MTN, Huawei, and China Telecom officially signed an agreement to deploy a P5G network at a manganese mine located in South Africa’s Northern Cape. The Northern Cape site was chosen for its strategic proximity as a central mining hub in the region, particularly for manganese and other bulk minerals, with P5G delivering enhanced safety, operational efficiency, and automation capabilities.

In September 2022, PT Freeport Indonesia’s Grasberg mine in Papua deployed a P5G network in partnership with Telkomsel and ZTE, enabling advanced applications like AI-based underground video analysis, unmanned driving, and intelligent tunneling. The deployment supports real-time monitoring, automation, and enhanced safety, resulting in a 25% increase in productivity, 40% cost savings, and a 20% reduction in energy use, demonstrating significant operational and efficiency gains.

In October 2023, Coal India Limited showcased a P5G deployment at its mines in Madhya Pradesh. This deployment, led by BSNL and Echelon Edge, uses spectrum allocated to BSNL and is designed to support video surveillance, asset tracking, IoT-based environmental monitoring, drone-assisted monitoring, digital twins, and collision avoidance systems.

India is actively deploying P5G networks in the mining sector, with the most notable project at Coal India Limited’s Amlohri Open Cast Coal Mines in Madhya Pradesh. This deployment, led by BSNL and Echelon Edge, uses spectrum allocated to BSNL and is designed to support video surveillance, asset tracking, IoT-based environmental monitoring, drone-assisted monitoring, digital twins, and collision avoidance systems. More recently, Coal India Limited has deployed P5G at its sites in Gujarat, Maharashtra, and Jharkhand using 3.5 GHz spectrum, with technology partners including Tidal Wave Technologies and Druid Software.

In June 2020, P5G was launched in the Xinyuan Coal Mine in China’s Shanxi Province by Huawei and China Mobile. An underground private 5G network was deployed to enable remote inspections, automate mining activities, and remotely-operated tunneling equipment.

Yimin Open-Pit Coal Mine in Inner Mongolia launched P5G in May 2025 using Huawei’s 5G-A network to power a fleet of 100 autonomous electric mining trucks and provide low-latency connectivity for real-time HD video backhaul, remote monitoring, and cloud-based fleet management.

In November 2023, the Caojiatan Coal Mine, located in China’s Shaanxi Province, deployed P5G for underground video calls, production supervision, and maintenance. IT enabled significant reductions in underground personnel, enhanced automation, real-time monitoring, and unmanned vehicle operations for coal production and transportation. The project also overcame substantial challenges in underground coverage and explosion-proof requirements by introducing low-frequency uplinks and REDCAP technology, ensuring robust and efficient connectivity throughout the mine.

P5G is emerging as a transformative enabler for the mining industry, powering advanced automation, enhancing worker safety, and supporting more sustainable operations. Its ability to deliver high bandwidth, ultra-low latency, and mission-critical reliability makes it particularly well-suited to the demanding conditions of both surface and underground mining.

Despite its potential, adoption remains uneven due to persistent challenges, including the complexity of underground RF planning, integration with legacy equipment, regulatory and spectrum hurdles, cybersecurity risks, skills shortages, and the total cost of ownership. However, these barriers are being progressively addressed through increased regulatory support, growing collaboration across the technology ecosystem, and a wave of successful pilot deployments.

The mining industry’s long-standing commitment to innovation, coupled with its accelerating digital transformation efforts, positions it well for broader P5G adoption. Notable deployments across Australia, North America, Latin America, Europe, Africa, and Asia Pacific reflect growing, albeit modest, momentum in the sector.

To ensure the successful adoption of P5G, mining companies should pursue a phased implementation strategy, beginning with pilot projects in high-impact areas to validate use cases, assess ROI, and build internal expertise. Integration with legacy systems will require close collaboration with vendors to develop compatible interfaces and maintain operational continuity. Establishing strong partnerships across the ecosystem, including technology providers, research institutions, and regulators, can accelerate deployment and align solutions with industry needs. Mining operators should also engage proactively with regulators to navigate spectrum policies and advocate for tailored allocations. Building workforce readiness through training and recruitment is essential, alongside embedding cybersecurity and resilience into network design. Leveraging advanced technologies such as edge computing, AI, and ruggedized equipment will help ensure reliability in challenging environments. Finally, mining companies should document and share deployment outcomes to promote transparency, support continuous improvement, and drive broader industry adoption.