September 2025

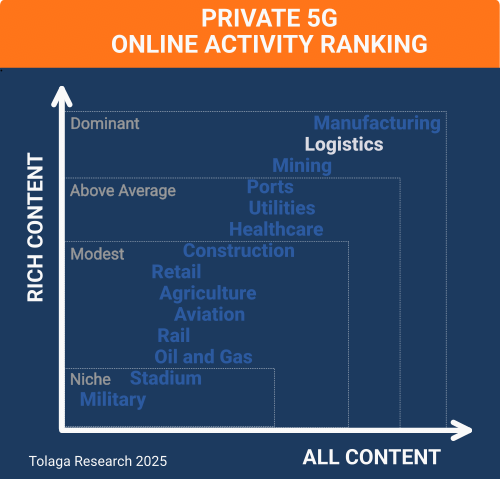

Logistics is an important sector P5G, with our online content survey ranking logistics 2nd out of the 14 industries researched.

Ericsson and Nokia are most prominent online for P5G in logistics with deployments that replace Wi-Fi with secure, high-performance connectivity to enable automation, real-time tracking, robotics, and advanced analytics to improve efficiency, safety, and scalability.

Proven Benefits, Limited Scale: Private 5G has demonstrated clear advantages in logistics, particularly in warehouses and fulfillment centres, by enabling reliable connectivity, low latency, and support for advanced automation. However, adoption is still in its early stages, with only a small number of 3PL providers publicly confirming deployments.

Tier 1 Leadership: Leading logistics companies, such as Amazon, JD Logistics, DB Schenker, and CJ Logistics, are acting as early adopters, utilizing P5G to showcase real-world applications. Their deployments serve as reference points for the industry, establishing benchmarks in automation, efficiency, and digital transformation.

Barriers to Adoption: High infrastructure costs, integration with legacy systems, and the requirement for specialised expertise remain significant obstacles, particularly for smaller and mid-tier providers. Regulatory uncertainty and labour market pressures add further complexity.

Future Outlook: As technology matures, digital transformation initiatives advance, costs decline, and ecosystem support grows, P5G adoption is expected to accelerate. While not yet a widely adopted solution, P5G has the potential to become an essential enabler of logistics innovation and a foundational building block for long-term digital transformation.

Effective logistics is essential across industries, enabling the efficient movement of goods, shaping production schedules, managing inventory, and enhancing customer satisfaction. The sector is undergoing digital transformation, creating both opportunities and challenges. Emerging technologies, such as artificial intelligence, automation, and data analytics, are driving efficiency gains, enhancing supply chain visibility, and meeting the growing demand for faster and more reliable deliveries. Automation is reshaping warehouse operations, while the Internet of Things and blockchain provide transparent, end-to-end tracking.

Adoption, however, remains uneven due to high costs, integration challenges, and workforce adaptation requirements. External pressures, including labor shortages, changing regulations, and market volatility, further slow progress and increase risk. While Tier 1 companies, such as Amazon, DB Schenker, DHL, FedEx, and UPS, have accelerated their digital transformation, broader adoption is advancing more gradually as others balance innovation with operational realities.

Private 5G (P5G) is emerging as a key enabler of digital transformation in logistics; however, its adoption is proving more complex than anticipated. In interviews conducted with third-party logistics (3PL) companies around 2022, more than 90 percent indicated plans to deploy P5G by 2024. To date, only eight of the top 50 3PL providers have publicly announced deployments, trials, or adoption plans. Some have tested P5G without formal announcements, but most have yet to take the step. When deployed, P5G delivers higher performance, stronger security, and greater capacity, while supporting advanced applications, including autonomous robots, drones, and intelligent warehouse systems. However, deployment remains difficult due to high infrastructure costs, integration with legacy systems, and the need for specialized expertise. These barriers are particularly challenging for smaller providers.

Online content published since 2022 that related to P5G in logistics was collected and filtered using proprietary web crawling, AI, and NLP tools, yielding a corpus of 288 relevant impressions (ALL CONTENT). Of this, 251 focused on company activity in the sector (RICH CONTENT), identifying 224 companies. Approximately 37.0 % of the content in the corpus referenced multiple industry verticals in addition to logistics, with an average of 2 to 3 other industries mentioned in this content.

The chart below compares the content corpus for P5G in logistics against other industry verticals to gauge relative market momentum. The analysis indicates that logistics is currently a dominant vertical market segment for P5G.

Natural language processing (NLP) and AI tools were used to identify companies mentioned in the content corpus, measure their prevalence (BREADTH), and evaluate how frequently they appear alongside other companies (DEPTH). For the companies identified, the ranking of the top 10 is shown in the chart below.

Ericsson is deploying P5G in logistics for a variety of use cases that include automation, real-time tracking, and device coordination across warehouses and distribution centers. The networks improve efficiency, safety, and scalability compared to Wi-Fi, enabling smoother material flows and better management of automated vehicles and robotics.

Nokia is enabling P5G in logistics to support smart warehouses, AGVs, robotics, and real-time tracking through its Digital Automation Cloud and MX Industrial Edge platforms, improving supply chain visibility, efficiency, and safety.

NLP and AI techniques were used to identify and classify keywords and phrases in the content corpus into 21 topics. Their frequency was measured (BREADTH) and their inter-relationships analyzed (DEPTH). The chart below shows the top 10 topics.

The most prominent topics in online content today are compute and communications, Logistics 4.0, and Supply Chain 4.0. Over time, we expect use-case-driven themes such as intralogistics and intermodal transport to gain prominence as digital solutions continue to mature.

Some global logistics providers are adopting P5G to replace Wi-Fi and enable automation, robotics, and real-time tracking across warehouses, distribution centers, and logistics hubs. Deployments by Amazon, CJ Logistics, DB Schenker, Nippon Express, Arvato, JD Logistics, ID Logistics, DHL, and Qube Holdings demonstrate benefits such as higher productivity, lower costs, improved safety, and scalable digital transformation. Several notable use cases are summarized below.

Amazon began deploying P5G in its fulfilment centres during 2021 and 2022, coinciding with the development and launch of the AWS Private 5G solution in November 2021. Although AWS retired the service in May 2025, citing challenges with spectrum availability and third-party hardware requirements, Amazon continues to operate P5G across its fulfillment network.

The company uses P5G to deliver reliable, scalable wireless coverage that supports warehouse automation, mobile robotics, and logistics operations. This approach replaces traditional Wi-Fi with fewer 5G small cells, providing more efficient coverage of large indoor and outdoor areas. P5G offers low latency and high reliability for business-critical systems, while enabling rapid network scaling and secure device management. Together, these capabilities improve operational efficiency and help reduce costs.

CJ Logistics is a South Korean global logistics company that provides integrated supply chain management services. In October 2021, CJ Logistics announced plans to deploy a P5G network at its Ichiri facility in Icheon City, South Korea, in collaboration with Ericsson. The company continued to expand the network capabilities and, in 2023, reported achieving 20% productivity gains and 15% capital expenditure savings. These improvements result from seamless wireless connectivity, supporting critical technologies such as warehouse robots, scanners, and automated guided vehicles (AGVs), which enhance material flow, safety, and operational control across extensive warehouse facilities.

In 2018, German logistics company DB Schenker partnered with Telia and Ericsson to install 5G connectivity at its Jönköping facility in Sweden. This installation supported Einride’s autonomous, all-electric “T-pod” trucks in continuous operation as part of a proof-of-concept for advanced logistics automation. In May 2019, DB Schenker and Einride launched the world’s first commercial deployment of a cab-less, fully electric autonomous truck on a public road at the Jönköping site. Since then, DB Schenker has continued to emphasise digital transformation, sustainability, and advanced automation, with Jönköping serving as a reference point for ongoing innovation.

In June 2021, Nippon Express, a leading Japanese logistics company, partnered with NEC to advance digital and automation initiatives in its warehouse operations. The project leverages NEC’s 5G technology to enable real-time control and data collection for applications such as remote-controlled robotics and automated picking. This P5G deployment is designed to enhance labor efficiency, improve safety, and strengthen supply chain visibility, while supporting Nippon Express’s broader goal of digitally transforming its logistics facilities to address labor shortages and boost operational performance.

Arvato, a third-party logistics (3PL) company headquartered in Gütersloh, Germany, partnered with Telefónica in early 2023 to deploy a P5G network at its logistics center. This network overcomes the limitations of Wi-Fi by providing highly reliable, low-latency connectivity that enables advanced digital applications such as autonomous transport systems, logistics drones, and wireless scanners. These technologies accelerate critical logistics processes, including product registration, sorting, and shipping. The private 5G deployment also underpins Arvato’s broader digitalization and innovation strategy, driving productivity improvements, enhanced operational flexibility, and fostering the adoption of new Industry 4.0 technologies in logistics.

JD Logistics, the supply chain division of JD.com, has implemented P5G networks in several warehouses in China, including a distribution center in Changsha. The networks connect over 100 automated guided vehicles (AGVs), providing stable, low-latency communication that Wi-Fi can't match. They also support applications such as automated material handling, warehouse monitoring, traceability, and IoT-based management systems. JD Logistics began deploying P5G in 2019 and continues to expand its use across logistics and supply chain operations.

ID Logistics Group, a leading French 3PL provider, partnered with Orange Poland in 2023 to deploy a P5G network at its Mszczonow facility. The network supports warehouse operations with automation and remote equipment control, while providing reliable connectivity across the site. It enables advanced logistics applications, including robotic systems and real-time data management for inventory and supply chain processes.

DHL, one of the world's largest logistics companies and headquartered in Bonn, Germany, announced an eight-year alliance with BT Group in 2022 and 2023 to upgrade its networks across 27 European countries. The announcement primarily focused on SD-WAN and SD-LAN with Wi-Fi 6, while also offering flexibility to support P5G. DHL highlighted potential applications, including autonomous vehicles, real-time tracking, Internet of Things devices, and augmented reality in warehouses.

Qube Holdings, Australia’s largest integrated import export logistics provider, has deployed P5G in collaboration with Ericsson at its Moorebank Logistics Park facility in Sydney. The P5G network is used to connect and coordinate automated cargo vehicles with reliable and low-latency connections to drive automation and real-time logistics orchestration.

P5G is beginning to demonstrate clear value in the logistics sector, particularly in warehouse and fulfilment operations where traditional Wi-Fi cannot provide the reliability, coverage, or low latency required for automation at scale. Case studies from leading providers, including Amazon, JD Logistics, DB Schenker, CJ Logistics, and Arvato, demonstrate how P5G can support autonomous vehicles, drones, robotics, and advanced data-driven processes that enhance efficiency, safety, and supply chain visibility.

Despite these successes, adoption remains limited. Fewer than one in five of the top 3PL companies have publicly confirmed deployments, and most projects remain in pilot or early-stage rollouts. High infrastructure costs, integration with legacy systems, and the need for specialized expertise continue to slow broader uptake. External pressures, such as labor shortages and regulatory complexity, also pose significant challenges.

Nevertheless, the momentum is evident. Tier 1 players are setting benchmarks that will inform industry-wide standards and business cases, while smaller providers closely monitor the developments to assess timing and feasibility. As spectrum availability improves, equipment costs fall, and equipment vendors and integrators build stronger 5G ecosystems, adoption is likely to accelerate. Private 5G is not yet a universal logistics solution, but it is emerging as a foundational technology for the sector’s digital transformation.