Publish Date: September 2025

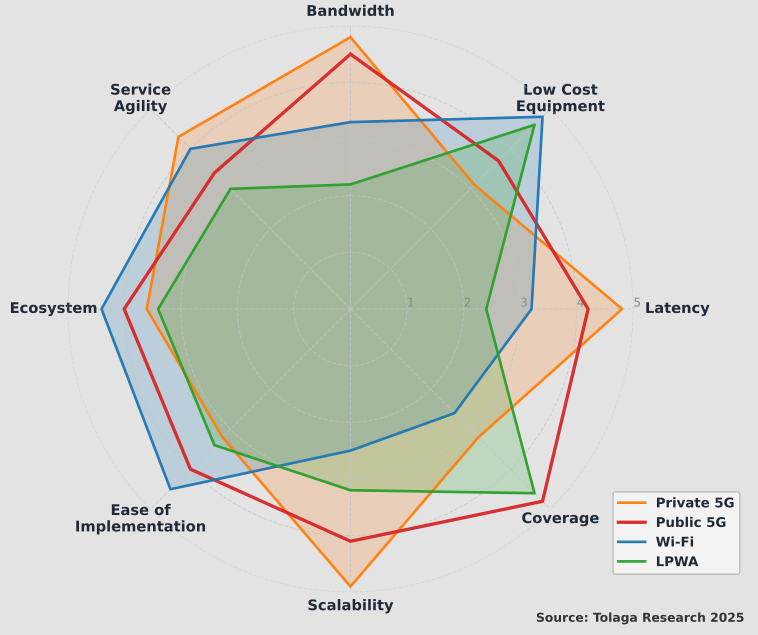

The value proposition: Private 5G (P5G) provides greater reliability, scalability, and security than Wi-Fi or LPWA networks, positioning it as a suitable technology for industrial digital transformation.

A positive market outlook: The global market for P5G infrastructure is forecast to grow from about USD 3.8 billion in 2025 to more than USD 10.7 billion by 2030, representing a CAGR of 23%.

Adoption trends: Uptake is most advanced in manufacturing, logistics, mining, and ports. Other sectors remain at earlier stages, with less proven or weaker value propositions.

An expanding industry landscape: The market is led by major vendors such as Ericsson, Nokia, and Huawei, along with service providers including Verizon, AT&T, and Vodafone. A growing group of specialist providers, such as Airspan, Boldyn Networks, Cellnex, Druid Software, Federated Wireless, Mavenir, Moso Networks, and Weaverlabs, are also active, in some cases capitalising on standardisation initiatives, including Open RAN.

Adoption constraints: High capital costs, spectrum access, legacy system integration, cybersecurity risks, and limited in-house expertise continue to restrict broader deployment.

Wireless connectivity is a critical enabler for industries undergoing digital transformation and adopting technologies such as IoT (Internet of Things), artificial intelligence, robotics, and autonomous systems. This is especially important for organizations that must connect large numbers of physical devices. A range of wireless solutions can support these needs, including Private 5G (P5G), Public 5G, Wi-Fi, and Low-Power Wide-Area (LPWA) networks.

Among these, P5G offers superior capabilities, beginning with its high bandwidth, low latency, and robust scalability relative to Wi-Fi. It can be implemented with dedicated network infrastructure and radio spectrum, or using dedicated network slices on public networks. The demanding performance attributes associated with P5G make it well-suited for demanding digital services, while its agility, particularly when combined with Open RAN architectures, further enhances its value for advanced industrial use cases. Additionally, P5G can potentially integrate seamlessly with Public 5G in hybrid deployments, enabling industries to benefit from both localized high-performance networks and the extensive coverage of public infrastructure.

P5G has experienced relatively robust growth in recent years, driven by digital transformation initiatives and increased demand for high-performance wireless connectivity. In 2025, we believe that the global market for P5G network infrastructure will reach $ 3.8 billion and increase at a cumulative annual growth rate of 23.0 % to reach $ 10.7 billion by 2030.

Our current forecast for the P5G market reflects our best assessment of the most likely trajectory, drawing on known market activity, anticipated expansion, and historical precedents from comparable adoption scenarios. As the market develops and becomes better understood, these assumptions may evolve. Sensitivity analysis is crucial when business models and business results depend on forecast outcomes, particularly when longer-term horizons (e.g., 10 years) are required for financial modeling and investment decisions. The sensitivity of the P5G forecast is illustrated below with the 2025 market size ranging from $3.0 to $4.0 billion, with five- or ten-year CAGRs between 10% and 40%. Additionally, multiple adoption profiles are used to illustrate the impact of different annual growth rates across the forecast horizon.

Select Forecast Profile:

30%

3.8 bUSD

To avoid unrealistic forecast predictions, it is helpful to reference the forecasts to other known markets. For example, the current total 4G equipment market is estimated to be between USD 65 and 70 billion annually in the 2024 and 2025 timeframe. Global enterprise Wi-Fi network equipment expenditures range from USD 7.0 to USD 10.0 billion annually and the enterprise network equipment market ranges from USD 75 to USD 120+ billion.

Manufacturing, logistics, mining and ports dominate the online narrative for P5G. The railway industry is underrepresented relative to its industry activity, while retail is overrepresented. Other sectors, such as stadiums, are complicated by the blurred distinction between public and private 5G, particularly when B2C services are supported.

The online activity ranking chart above suggests that manufacturing, logistics, mining, ports, utilities, and healthcare are the leading adopters of P5G. Adoption in these sectors is driven by P5G's superior reliability, security, and scalability compared to alternatives such as Wi-Fi, advantages that help offset its higher costs and deployment complexity. However, P5G adoption is still in its early stages, and historical data provide only a partial view of its trajectory. As the industry matures, solutions such as "P5G in a box," more efficient Open RAN architectures that integrate network functions into service platforms, and the broader availability of private spectrum (for example, the CBRS band) will help reduce implementation barriers. At the same time, as enterprises advance their digital transformation initiatives, the demand for high-performance connectivity that P5G uniquely enables will continue to accelerate.

The chart below illustrates the online activity of companies delivering P5G solutions. So far, the landscape has been led by Tier 1 equipment vendors such as Ericsson, Nokia, and Huawei, together with major service providers including Verizon, AT&T, and Vodafone. Beyond these, the 1018 companies identified in the survey reveal a diverse ecosystem of specialist and emerging players, including Airspan, Boldyn Networks, Cellnex, Druid Software, Federated Wireless, Mavenir, Moso Networks, and Weaverlabs.

P5G is gaining traction as a wireless connectivity technology in manufacturing, enabling Industry 4.0 and 5.0 through advanced use cases such as robotics, autonomous vehicles, real-time analytics, digital twins, and smart logistics. Global leaders, including BMW, Airbus, Tesla, BASF, and Ford, are already deploying P5G to enhance efficiency, agility, and innovation on the factory floor, leveraging its superior reliability, scalability, and security compared to legacy wireless systems. Despite its potential, adoption remains uneven due to high upfront costs, complex IT/OT integration requirements, device compatibility issues, and limited in-house expertise, particularly among small and mid-sized enterprises. Early rollouts have sometimes faced challenges in delivering clear returns on investment, yet the technology is rapidly maturing through improved standardization, modular solutions, and partnerships with experienced integrators. As manufacturers strategically align P5G with broader digital transformation initiatives, it is set to become a key catalyst for resilient, intelligent, and human-centric production.

P5G is emerging as a valuable connectivity technology in logistics, particularly in warehouses and fulfillment centers, where it delivers reliable, low-latency connectivity to support automation, robotics, and advanced data-driven operations. Leading companies such as Amazon, JD Logistics, DB Schenker, CJ Logistics, Nippon Express, and Arvato have pioneered deployments, showcasing productivity gains, efficiency improvements, and new applications that exceed the capabilities of Wi-Fi. Despite these successes, adoption remains limited; fewer than one in five top third-party logistics providers have confirmed rollouts. This is mainly due to high infrastructure costs, integration challenges, regulatory uncertainty, and the need for specialized expertise. As spectrum availability improves, costs decline, and ecosystem support expands, adoption is expected to accelerate, with Tier 1 players setting benchmarks for the broader industry. While still in its early stages, P5G is positioned to become a foundational enabler of digital transformation in logistics.

Some Tier 1 mining companies have adopted P5G, particularly where operations demand high reliability, low latency, and robust connectivity in remote and hazardous environments. By supporting autonomous vehicles, IoT sensors, digital twins, and connected worker systems, P5G can enhance safety, optimize efficiency, and contribute to more sustainable practices. It offers advantages over Wi-Fi, TETRA, and LPWA networks by delivering greater bandwidth and mission-critical performance, though adoption remains uneven due to challenges in underground coverage, legacy system integration, regulatory compliance, cybersecurity, and costs. Demonstrated deployments across major mining regions, including Australia, North America, Latin America, Europe, Africa, and Asia Pacific, show measurable improvements in productivity, safety, and environmental outcomes. Broader adoption will depend on phased rollouts, ecosystem partnerships, regulatory engagement, and workforce training to fully realize P5G’s potential in transforming mining operations.

Ports worldwide are deploying P5G to provide secure, high-speed, low-latency connectivity that supports automation, real-time monitoring, and intelligent logistics. It enables applications such as remote crane control, autonomous vehicles, predictive maintenance, and AI-driven surveillance, improving efficiency, safety, and sustainability while lowering operational costs and emissions. P5G integrates with digital twins, edge computing, and IoT systems to enhance data-driven decision-making. Adoption is progressing at major ports in Asia, Europe, and North America, though challenges include high capital costs, spectrum licensing, integration with legacy systems, and the need for specialized expertise. Effective implementation typically requires collaboration between port authorities, telecom operators, equipment vendors, and regulators. P5G is becoming an essential infrastructure for the digital transformation of port operations.

Utilities are adopting P5G to improve reliability, security, and efficiency in electricity, gas, and water systems. Current deployments are concentrated in the electricity sector, with applications in smart metering, grid automation, remote inspections, and distributed energy integration, while gas and water utilities are at earlier stages. Examples include Memphis Light, Gas, and Water, Southern California Edison, EDF, ČEZ, China's State Grid, China Southern Power Grid, Kansai Electric Power, Korea Electric Power, Korea Hydro & Nuclear Power, Nobelwind, Portland General Electric, and pilots in Germany’s water sector. These projects demonstrate P5G's ability to support functions such as predictive maintenance, outage detection, real-time analytics, drone inspections, and secure field communications. Adoption is hindered by high costs, the need for legacy system integration, regulatory complexity, and cybersecurity risks. Utilities are addressing these challenges with phased pilots, vendor partnerships, regulatory engagement, and workforce training to establish secure, scalable, and compliant networks.

Healthcare facilities are adopting P5G to provide high-speed, low-latency, and secure wireless connectivity, enabling applications such as remote surgery, real-time imaging, AI-driven diagnostics, telemedicine, and continuous patient monitoring. Hospitals in Europe, the U.S., and Asia are using P5G for AR-assisted surgeries, robotic systems, logistics automation, and digital twin diagnostics, with examples including Oulu University Hospital in Finland, Cleveland Clinic in the U.S., and Samsung Medical Center in South Korea. P5G also supports rural outreach through telemedicine and mobile healthcare units. Compared with Wi-Fi, it offers greater reliability, scalability, and compliance with healthcare data security requirements. Barriers to broader adoption include high costs, technical complexity, spectrum constraints, interoperability challenges, and in-house skill gaps. Progress depends on vendor partnerships, standards-based architectures, cybersecurity measures, and targeted pilot projects. Early implementations show improvements in efficiency, care quality, and patient access, but widespread adoption has not yet been achieved.

P5G has been adopted in construction to enable real-time monitoring, automation, remote collaboration, and safety applications across large or complex sites. Case studies, including those of Merck, the Silvertown Tunnel, Hoban, Gammon, and Ferrovial, demonstrate deployments that support AI-based hazard detection, smart wearables, digital workflows, and environmental monitoring. P5G offers reliability, low latency, and security; however, its adoption is constrained by high costs, technical complexity, spectrum access issues, and limited in-house expertise. Solutions such as modular “5G-in-a-box,” hybrid networks, and partnerships with experienced providers are being used to address these barriers. P5G is

P5G is being trialed in retail to support applications such as cashierless checkout, smart shelves, inventory tracking, and supply chain visibility. Deployments include American Tower's network at Miracle Mile Shops in Las Vegas, HPE Aruba’s portfolio adopted by Home Depot and Ross Stores, and neutral host solutions from vendors such as Nokia and Andorix. P5G offers greater security, reliability, and capacity than Wi-Fi, particularly in environments with large numbers of IoT devices or advanced services such as AR/VR. Adoption is still limited due to cost, deployment complexity, and integration challenges with existing Wi-Fi systems, but interest is increasing with the availability of solutions like "P5G-in-a-Box" and growing demand for automation, real-time analytics, and enhanced customer engagement.

P5G is emerging as an enabler for digital agriculture by delivering secure, high-speed, and low-latency connectivity to support IoT devices, autonomous machinery, and AI-driven analytics, particularly in rural areas where existing wireless infrastructure is limited. Early deployments, ranging from autonomous farms in China and livestock monitoring in Japan to viticulture in Germany and agribusiness pilots in Brazil, Australia, and the United States, demonstrate improvements in productivity, efficiency, sustainability, and food system resilience. Typical applications include precision irrigation, predictive maintenance, automated harvesting, and real-time livestock health monitoring. However, most projects remain pilot initiatives supported by public funding and industry collaborations, with adoption constrained by high costs, technical complexity, and limited on-farm IT expertise. Scaling P5G in agriculture will require clearer demonstrations of ROI, simplified deployment models, and collaborative ecosystems that can help bridge capability gaps and make the technology accessible to a broader range of producers.

P5G provides secure, high-speed, and low-latency connectivity that supports aviation applications such as autonomous vehicles, AI-enabled surveillance, predictive maintenance, and digital twins. Airports including Frankfurt, Hong Kong, Dallas-Fort Worth, San Sebastian, and Langkawi have deployed P5G to improve operational efficiency, safety, and passenger services. Adoption is constrained by high costs, legacy system integration, regulatory requirements, and skills shortages, but phased rollouts focused on targeted use cases are delivering measurable benefits. Supported by government funding and industry partnerships, P5G offers more reliable and scalable performance than Wi-Fi and is positioned as a foundational technology for modernizing airport infrastructure.

Some railways are adopting P5G to provide secure, high-speed, and low-latency connectivity for applications such as autonomous train trials, predictive maintenance, real-time video monitoring, and AR-enabled operations. Europe is leading adoption through the development of the Future Railway Mobile Communication System (FRMCS), while Asia is advancing with initiatives such as China’s 5G-R, Japan's Local 5G, and South Korea's railway deployments. Operators including Deutsche Bahn, SNCF, and ÖBB are conducting trials, and projects in the UK and other regions are underway. Migration is gradual due to cost, integration with legacy systems, and the slow finalization of FRMCS standards, with rollout expected into the 2030s. Hybrid networks that combine public and private 5G are emerging as operators modernize their infrastructure and prepare for future standards.

Several players in the oil and gas industry are adopting P5G to support real-time monitoring, predictive maintenance, automation, and remote operations in complex and hazardous environments. Leading companies such as ADNOC, PETRONAS, Aramco, and Aker BP have launched large-scale deployments that demonstrate measurable efficiency, safety, and sustainability benefits, while others like Centrica Storage, PCK Refinery, and Changqing Petrochemical are leveraging P5G to enhance operational continuity and environmental performance. Despite this momentum, adoption remains uneven due to high costs, integration complexity, spectrum constraints, and uncertain ROI, especially among firms with lower digital maturity. The most effective path forward is a targeted, phased approach focused on high-value use cases, cross-industry collaboration, and pilot projects that clearly demonstrate operational and financial benefits and position P5G as a strategic enabler of long-term competitiveness in a digitally driven, decarbonizing energy landscape.

Private 5G provides high-capacity, low-latency, and secure connectivity for stadiums, enabling applications such as immersive fan experiences, real-time media production, smart crowd management, and efficient venue operations. Deployments in Europe, North America, and other regions demonstrate its performance in high-density environments, supporting live broadcasting, AR/VR engagement, and advanced analytics. Adoption is limited by deployment costs, spectrum availability, and integration challenges, with return on investment dependent on the development of compatible applications and supporting ecosystems. Effective implementation requires partnerships with technology providers and a strategic approach that positions P5G as part of a broader digital transformation in sports and entertainment venues.

Some military organizations are adopting P5G to provide secure, high-speed, and resilient communications that enable real-time data exchange, autonomous systems, smart base operations, and advanced training. NATO, the EU, and national defense forces, including those in the United States, United Kingdom, China, India, and Australia, are piloting and deploying P5G for command and control, logistics, cyber training, and battlefield operations. Programs such as Lockheed Martin’s 5G.MIL and the EU-funded 5G-MILNET are integrating commercial 5G with military-grade systems to improve resilience, interoperability, and mission-critical communications. Key priorities include Open RAN adoption, local industry involvement, and secure, spectrum-efficient deployments. Challenges include spectrum access, integration with legacy systems, deployment cost, and supply chain security. Adoption is progressing through phased, hybrid approaches that combine private military and commercial network deployments.

Private 5G is establishing itself as a key wireless technology for industrial digital transformation, offering higher reliability, security, and scalability than alternatives such as Wi-Fi or LPWA networks. Although adoption is still in its early stages and constrained by cost, integration, and expertise challenges, the market outlook is strong. Infrastructure revenues are expected to grow from $3.8 billion in 2025 to more than $20 billion by 2030, representing a CAGR of 40 %. Early deployments in sectors such as manufacturing, logistics, mining, ports, utilities, and healthcare are showing practical benefits, and a diverse ecosystem of vendors is supporting progress. As spectrum becomes more available, deployment models are simplified, and integration frameworks improve, adoption barriers are likely to ease. Private 5G will play a growing role in high-performance connectivity for industries worldwide.